Although average Americans spend just 10% of their disposable income on food, we could be saving even MORE money. If you’re a PN eater, you might just end up richer than you think… and healthier too.

Disposable income: The income (after taxes) that is available to you for saving or spending.

Most Americans spend about 10% of their disposable income on food. For the non-math buffs, this means 90% of each dollar is NOT spent on food.

This is a unique situation. We used to spend more. In the 1930s, 25% of disposable income was spent on food.

Other countries generally spend more than Americans. Japanese people spend, on average, 13%. In France they spend 14%, China is 28% and India is at 39%.

How does your spending compare?

Check yourself

I’ve noticed two main categories of people who have a hard time affording healthy food.

Category #1

The person who cuts unnecessary expenses, develops a spending plan each month, and simply cannot afford to spend much on food due to budget constraints and a low income.

Category #2

The person who spends a high percentage of their income on unnecessary things, has no spending plan each month, and then curses the “food pricing gods” about food being too expensive.

Think you’re short on cash for nutritious food? Think again.

The average adult in the U.S. spends about $62 on video games, $45 on porn, and only $20 on organic produce each year. Assuming that someone highly values their health, you’d think food expenditure would be a top priority. Let me introduce you to cognitive dissonance.

The true cost of food

Here’s something scary. Many people complain about how expensive food is. But in fact, prices have been artificially low for years, due to government subsidies and unsustainable, high yield farming practices. If we factor in everything from raw ingredients to the environmental costs of growing food to the costs of producing and transporting it… we realize we haven’t been paying the true cost of food at all.

Here’s an example. Let’s say two kids run two lemonade stands.

One kid’s parents buy her all her stuff: lemons, sugar, a jug to serve it in, etc. They pay for the water that comes out of the tap to make it. They pay for the house that has the driveway in which the kid can set up the stand. (Or their taxes pay for the sidewalk.) They pay for the folding table on which the lemonade sits. They even supply the cardboard and markers so the kid can make a poorly spelled “LEMONADE FOR SALE” sign. This kid can charge 25 cents a cup and pocket it all as profit. Customers think 25 cents is probably a reasonable deal for making a kid learn about entrepreneurship.

The second kid’s parents don’t supply anything. The kid has to buy all his own ingredients. His parents don’t have a house so he has to rent someone else’s driveway. They don’t pay the water bill so the water got cut off… he has to buy bottled water (which itself has environmental costs). He has to buy his own table and equipment. How much do you think he can charge for lemonade in order to break even? I guarantee that customers will not think it’s a good deal!

The true cost of food is finally becoming apparent. If someone thinks $2/lb factory farmed beef is “expensive,” wait until they find an organic farmer that raises grass-fed.

The percentage of income spent on food in recent years is dropping, but we’re spending more on pharmaceuticals and surgeries.(1-3)

The 6 commandments of money saving nutrition

Let’s get real. No old school tips on clipping coupons and buying generic fruity-Os. While those might save you a few cents, we have a major issue here. We’re trying to eat quality food and not end up homeless in the process.

Money Saving Commandment #1: Buy more minimally processed plant foods

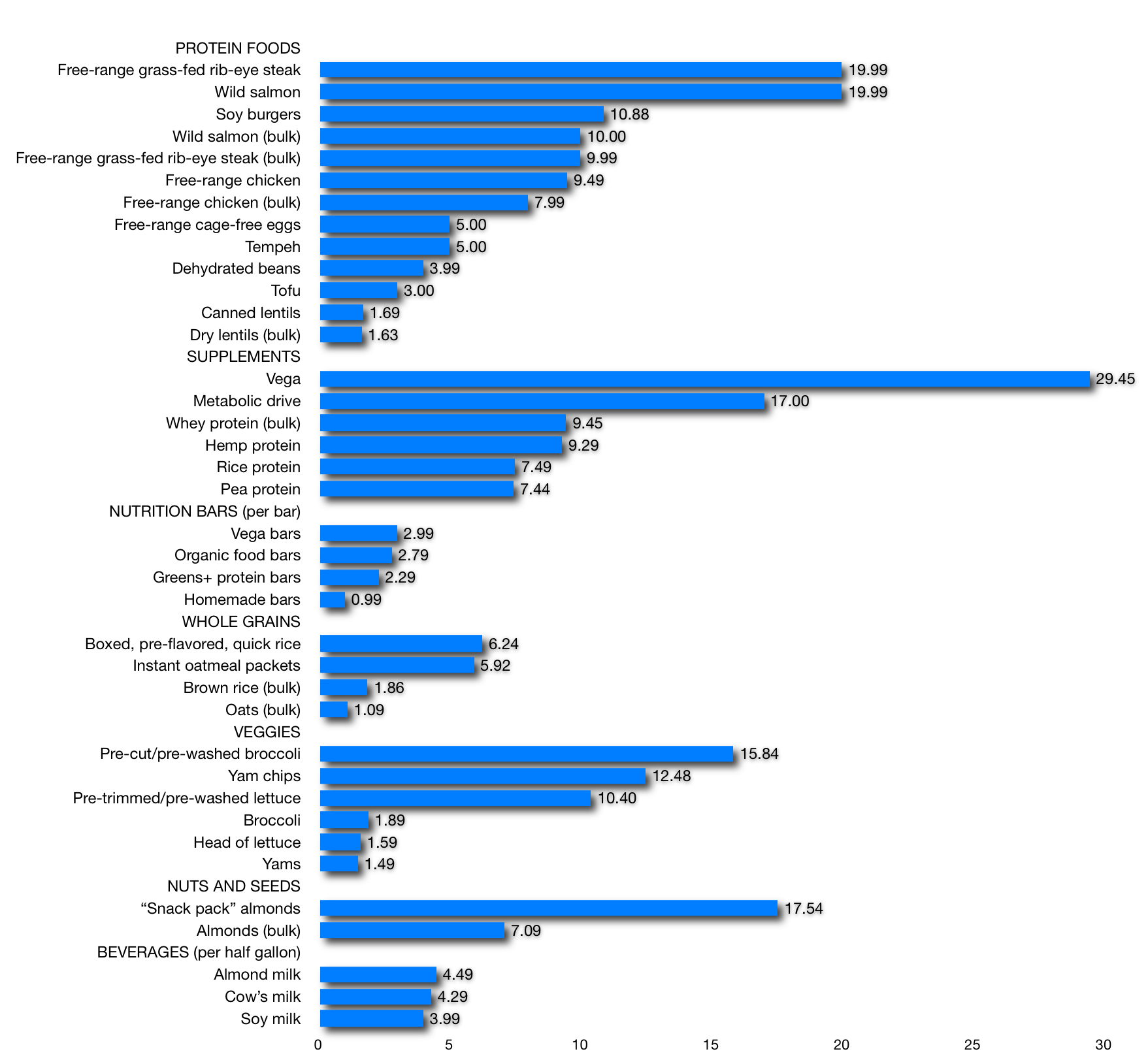

The healthiest and most inexpensive foods aren’t advertised or put into expensive/colorful packages. Vegetables, fruits, legumes, whole grains, nuts and seeds in their basic forms are extremely inexpensive. Check out these comparisons.

Notes:

- All comparisons were done with organic food at regular prices. No sales or specials.

- “Bulk” usually means you’re going to be getting a lot. You’ll spend a chunk of money up front, but in the long-term, it saves.

- That pound of dry lentils will make the equivalent of four cans.

- As you can tell from the list above, pre-packaged/convenience foods are very expensive. Be aware. Dry soy beans are cheap. Spiced up frozen soy burgers are the same price as most organic animal proteins. When you buy the “sexy” frozen meals, and pre-made foods, the cost gets into the “I can’t pay rent anymore” range.

- You’ll notice I didn’t include factory farmed/confined feed operation beef, chicken, pork or eggs. While that food option might save us a few dollars right now, it doesn’t seem to be a viable long-term food option, as it’s unsustainable. Buying conventional animal foods doesn’t seem to benefit health, the planet or sustainability. The true cost of healthy animal proteins is higher than what we’re accustomed to. When animals are raised in a healthy and sustainable fashion, it would be near impossible for society to afford high quantities of them on a regular basis. You vote with each dollar you spend. In the end, it’s your call.

Money Saving Commandment #2: Buy produce that’s about to expire

This stuff is marked down, big time. If you can’t find it at your market, ask the manager. Just make sure to use it ASAP or put it into long-term storage (like freezing it).

Money Saving Commandment #3: Check for damaged goods

A small dent, scratch or tear means you save money. There are bins at regular grocery stores stocking this food. In some regions, there are even entire grocery warehouses dedicated to re-selling slightly damaged foods. Obviously, these will be foods you find in boxes, cans and bags – so be smart. Use it as an opportunity to stock up on dry beans, grains, oils, nuts, and so on.

But don’t go “Big Daddy” and start intentionally damaging goods!

Money Saving Commandment #4: Shop at a farmers market or join a CSA program.

I haven’t found a convincing reason not to do this. You’ll be supporting local farmers, getting foods in season and saving money. We have a trifecta.

Find a farmers market or CSA using the sites below:

Wholesale and farmers markets

Folks in the UK:

Money Saving Commandment #5: Buy in bulk

This can be nearly anything: beans, nuts, seeds, frozen veggies, frozen lean meats, eggs, frozen fish, nut butters, whole grains, etc.

Yes, this will cost you more money up front.

Yes, this will save you money long-term.

Yes, this will cut down on packaging materials and waste.

No, bulk Twinkies aren’t a good idea.

Examples of bulk shopping online:

Money Saving Commandment #6: Pay with cash

When you get rid of the credit card(s), it’s tough to overspend. Trust me. When I have $20 cash for food, that’s all I spend. Well, unless I want to get a job at the grocery store and work off my debt.

A couple of warnings…

Warning #1

Incorporating the aforementioned tips will save you some serious cash – like 30 to 50%. You might even have more money to put away for retirement or tithe each month.

Warning #2

When you begin to purchase non-convenience foods, bulk foods, and items from the farmers market, you won’t have a lot of fun labels and packaging to read. Translation: No morning cereal box treasure hunts.

You make the food “fun” when you get home and prep it. Minimally processed foods don’t prepare themselves. This means getting home and simmering the grains, washing and cutting the veggies, and simmering the beans. Do your thing. Otherwise, the food will go uneaten. This means no money saved and no nutrients in your body.

No idea how to prepare food? Check out the following:

Quit your bellyaching!

Wait a minute…

So if eating nutritiously is so inexpensive, why do people still grumble so much?

First, it’s the “healthy/organic junk food” that’s a problem. This stuff is super expensive. We’re talking chips, cookies, crackers, desserts, etc. While I would encourage you to buy these items instead of the complete crap option, it’s usually not that much different, and should be eaten infrequently anyways (well, if you want to be lean and healthy).

For example:

Organic sugared cereal – $4.49/box

Generic sugared cereal – $1.49/box

Second, we have rationalization. Let’s face it, healthy foods aren’t more expensive, but preparing beans and rice for dinner takes time and effort. Plus, it’s not going to bring the same dopamine rush that a couple of items from the fast food value menu will.

In the end, PN eating will put more money in your savings. Here is a final comparison for good measure…

| Standard American Day Of Processed “Money Saving” Eating | Standard PN Day |

| Breakfast: Egg McMuffin – $2.40 Medium OJ – $1.70 Large Coffee – $1.50Lunch: Big Mac – $3.80 Medium fries – $1.55 Medium iced tea – $1.40Dinner: Premium salad with chicken – $4.95 Oatmeal raisin cookies – $1 Medium Coke – $1.40 |

PN Breakfast: Super Shake – $2.49 Sprouted grain toast with nut butter – $1.99PN Lunch: Beans – $0.49 Rice – $0.49 Peppers/onions – $0.49 Large Salad – $0.79PN Dinner: Chicken breast – $1.50 Marinara sauce – $0.89 Small Salad – $0.69 |

| Total: $19.70 | Total: $9.82 |

Other tips

Use food

Lots of canned chili sitting around? What about bags of quinoa? Dry beans? Frozen veggies? Use them!

Go on a “buying fast.” Use all of the food you have on hand. Make soups and stews. Get inventive!

You’ll be able to bank some money for a week or two. Then you can take that money and buy healthy food or Xbox games.

Free up existing income

Don’t get a third job with the local cobbler if you are short on food money. How about nixing the cell phone, downgrading plans, cutting the cable, getting rid of credit cards (and payments), walking and biking more instead of driving, getting into a rental/mortgage situation you can afford, not leasing a car, not leasing a plasma HD TV, etc.

These things are possible right now, and they will immediately free-up money you are already making.

Restaurant = special occasion

When eating out is a special occasion (for things like holidays, graduations, birthdays, etc.) instead of a daily thing, you’ll save money. Don’t believe me? Add it up.

Every day for a week, try:

- Bringing your lunch to work

- Making your own coffee and bringing it with you in a thermal mug

- Bringing fruit and veggies for snacks

- Making dinner at home

Watch the cash roll in!

Summary

If you are spending 10% of your disposable income on food, first consider where the other 90% of your income is going. Is it time to re-work your budget and free up existing income?

Once your spending plan is dialed in, save money by following these tips:

- Buy more minimally processed plant and animal foods

- Buy produce that’s about to expire

- Check for damaged goods

- Shop a farmers market or join a CSA program

- Buy in bulk

- Pay with cash

- Use food you already have

- Eat at restaurants for special occasions

Eat, move, and live… better.©

Yep, we know…the health and fitness world can sometimes be a confusing place. But it doesn’t have to be.

Let us help you make sense of it all with this free special report.

In it you’ll learn the best eating, exercise, and lifestyle strategies – unique and personal – for you.

Click here to download the special report, for free.

References

Click here to view the information sources referenced in this article.

Share